- Contact:Ms. Zhang

- Cel:0086-18053229518

- Mail:info@qdrunjuxiang.com

- Add:Chengma Road, Qijialing Village, Tongji New District, Jimo City, Qingdao

In 2026, a structural interest rate cut will occur, presenting a new opportunity for the textile industry to develop.

On January 19, 2026, the first structural "interest rate cut" of the year was implemented. The People's Bank of China lowered the rates for re-lending and re-discounting by 0.25 percentage points, injecting strong impetus into the high-quality development of the textile industry.

In terms of financing costs, the mechanism of this interest rate cut is unique. It reduces the cost for banks to obtain funds from the central bank and guides the allocation of credit. After the adjustment, the re-lending rates for supporting agriculture and small businesses have decreased, and the interest rates of special structural monetary policy tools have dropped as low as 1.25%. The financing costs for small and micro enterprises in the textile industry have significantly decreased. Previously, the loan interest rates for small and micro enterprises were generally between 3.8% and 4%. With the interest rate cut combined with supporting policies, the actual financing interest rates of enterprises are expected to further decline. Taking a loan of 5 million yuan as an example, for every 0.25 percentage point reduction in the annual interest rate, enterprises can save 12,500 yuan in interest per year, effectively alleviating the pressure on cash flow. Moreover, the central bank has increased the quota of structural monetary policy tools, and the low-cost capital pool of banks has expanded. The predicament of small and micro enterprises, such as "difficulties in obtaining loans and slow approval process", will be improved.

In terms of transformation and development, this interest rate cut aligns with the transformation needs of the textile industry. At the technological innovation level, enterprises are entering a funding window period for intelligent transformation. Under the "small batch quick response" model, enterprises need to update equipment. After the interest rate cut, the cost of technological transformation loans has decreased, allowing more funds to be invested in equipment upgrades and technological research and development. The new "data mortgage" model will also benefit. In the green transformation field, environmental protection policies are becoming stricter. The interest rate cut provides financial support for energy conservation and emission reduction renovations, promoting the industry's low-carbon and circular development.

In terms of the dual-cycle development, interest rate cuts help stabilize foreign trade and stimulate consumption. On the export side, the export of textile and clothing is significant. Interest rate cuts alleviate the capital turnover pressure of foreign trade enterprises, enabling them to flexibly respond to international market fluctuations. On the domestic demand side, interest rate cuts promote the improvement of product supply quality. Enterprises can increase research and development investment, develop new products, and tap into the potential of domestic demand.

This structural interest rate cut has brought dual opportunities of financing relief and transformation for the textile industry. Enterprises should seize the policy window period and accelerate their progress towards the directions of technology, fashion and green development, contributing to the transformation and upgrading of China's manufacturing industry.

Declaration: The content of this article is compiled from the internet and is copyrighted by the original author; if any infringement is found, please notify us immediately and we will delete it.

- Qingdao Runjuxiang: During the V

- 2026 Outlook: Strengthen interna

- Qingdao Runjuxiang: Commence wit

- New Year, New Momentum, New Jour

- Qingdao Runjuxiang: A New Year's

- In 2026, a structural interest r

- Qingdao Runjuxiang: A New Beginn

- Analysis of the Textile and Garm

- At the beginning of the new year

- The Impact of the Fed's Interest

- About RunJuXiang

- Company Profile

- Company Culture

- Non-woven production line

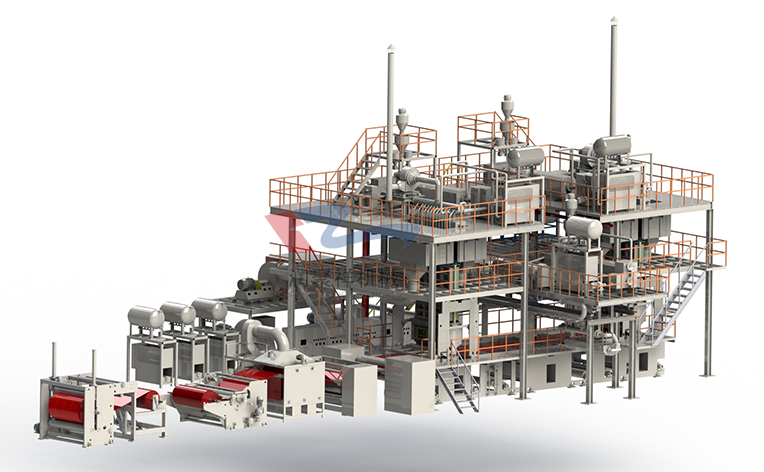

- Spunbond nonwoven production line

- Two-component Bi-Co

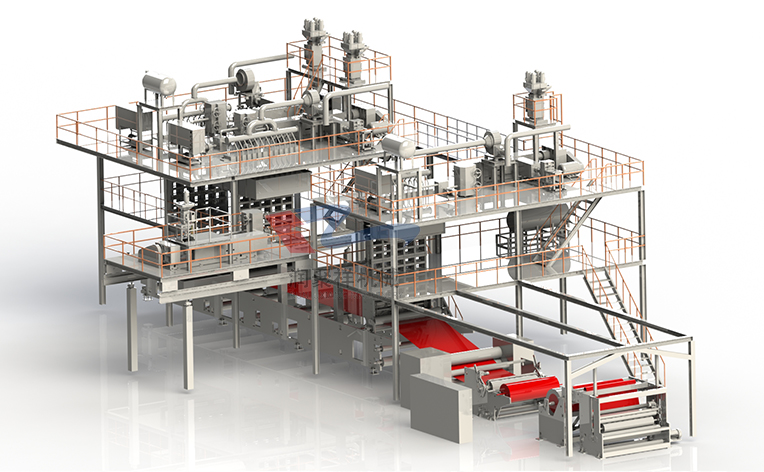

- Spun melted nonwoven production line

- Equipment Accessories

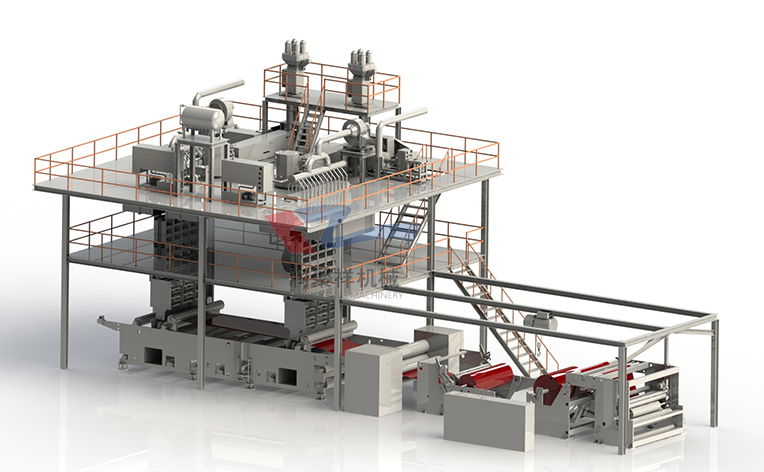

- Meltblown nonwoven production line

- Non-woven products

- News Center

- Company News

- Show Information

- Contact Us

- Contact RunJuXiang

- Online Message