- Contact:Ms. Zhang

- Cel:0086-18053229518

- Mail:info@qdrunjuxiang.com

- Add:Chengma Road, Qijialing Village, Tongji New District, Jimo City, Qingdao

New crown pneumonia is intensifying, the number of confirmed diagnoses in many countries is accelerating, the market panic continues, and the domestic financial market is difficult to survive. Yesterday, the Shanghai Stock Exchange Index closed down nearly 1%. The intraday once hit a 13-month low. The commodity market was dismal, precious metals, non-ferrous metals, etc. The sector fell across the board. As of the close of the afternoon session, more than a dozen commodities fell to their daily limit. The Mandarin Commodity Index bottomed out and hit the 128.34 line during the session, further close to the 2016 low of 106 line. The pessimism in the domestic cotton market has also deepened. It is understood that the overall performance of the domestic spot market is currently weak. Most of the orders for downstream weaving mills are only at the end of March. The purchase willingness has decreased significantly, and the inventory of textile companies has begun to accumulate. Affected by fundamentals and pessimistic market sentiment, Zheng Mian fell all the way down in the early trading, and the futures price fell sharply to close at the limit. The 05 contract ended at 11095 yuan / ton, down 435 yuan / ton. The moving average system continued to be short; The MACD green column volume is in a weak area below the 0 axis, the KD line fits the dead fork and diverges downward, and the technical indicators continue to be weak.

On March 19, the current price difference between Zhengmian 2005 contract and the CCI3128B index period was -1128 / ton, which was 385 yuan / ton lower than the previous trading day.

As of the close of March 19, Zheng Cotton's 2005-2009 contract spread was -440 yuan / ton, which was 20 yuan / ton higher than the previous trading day. There is no obvious arbitrage opportunity in the near future.

On March 19, the difference between the CCI index and the FC Index RMB index was 460 yuan / ton, and the price difference increased by 139 yuan / ton from the previous trading day; the ZCE2005-ICE2005 contract disc difference was 2293 yuan / ton, and the price difference decreased by 281 yuan from the previous trading day. /Ton.

As of March 19, Zheng cotton warehouse orders amounted to 35,165 (about 1.512 million tons), a decrease of 143 (6,149 tons) from the previous day, and the effective forecast amount was 4,584 (about 197,000 tons), a decrease of 88 from the previous day ( (About 3784 tons); the total amount of warehouse receipts and valid forecasts totaled 1.709 million tons.

Currently the US EMOT M arrives at 68.25 cents / lb, India S-6 1-1 / 8 arrives at 67.5 cents / lb, Brazil M arrives at 68.25 cents / lb, and the arrival price of foreign cotton has dropped sharply. , Down 1 cent per pound. The number of newly diagnosed coronaviruses has accelerated, and the United States has become the sixth country in the world to have 10,000 new coronavirus cases. Various countries have successively introduced relevant policies to stabilize the economy, and the European Central Bank announced a plan to acquire 750 billion euros in bonds. The Bank of England urgently cut interest rates and expanded the scale of debt purchases. The US Federal Reserve again recruited 9 major central banks to establish a USD swap arrangement. In addition, US President Trump ’s speech on vaccine drugs further boosted market confidence. US stocks closed higher on Thursday. The Dow regained the 20,000 mark. The biggest single-day increase in history. Affected by the epidemic, the sales data of upland cotton fell slightly in the week of 3.5-3.12. Upland cotton contract sales were 77,268 tons, a decrease of 30% from the previous week. Upland cotton shipments were 83,811 tons, a 13% decrease from last week's shipments. ICE futures plunged to a more than 10-year low due to demand worries. The lowest price reached 53.64 cents / lb. It closed at 55.31 cents / lb on Thursday, down 1.46 cents / lb, a drop of more than 2.5%. The moving average system continues to be short, MACD green bars are heavy, and the technical indicators are weak. Pay attention to the changes in the future positions. The recent price range is 52-58 cents / lb.

New crown pneumonia is intensifying, the number of confirmed diagnoses in many countries is accelerating, the market panic continues, and the domestic financial market is difficult to survive. Yesterday, the Shanghai Stock Exchange Index closed down nearly 1%. The intraday once hit a 13-month low. The commodity market was dismal, precious metals, non-ferrous metals, etc. The sector fell across the board. As of the close of the afternoon session, more than a dozen commodities fell to their daily limit. The Mandarin Commodity Index bottomed out and hit the 128.34 line during the session, further close to the 2016 low of 106 line. The pessimism in the domestic cotton market has also deepened. It is understood that the overall performance of the domestic spot market is currently weak. Most of the orders for downstream weaving mills are only at the end of March. The purchase willingness has decreased significantly, and the inventory of textile companies has begun to accumulate. Affected by fundamentals and pessimistic market sentiment, Zheng Mian fell all the way down in the early trading, and the futures price fell sharply to close at the limit. The 05 contract ended at 11095 yuan / ton, down 435 yuan / ton. The moving average system continued to be short; The volume of the MACD green column is in a weak area below the 0 axis, the KD line fits the dead fork and diverges downward, and the technical indicators are in a weak state.

【technical analysis】

Yesterday, after the Zheng cotton 05 contract opened lower in the morning, it fell all the way, the futures price fell sharply, and closed at the limit. At the end of the session, it closed at 11095 yuan / ton, down 435 yuan / ton. The moving average system continued to be short; In the following vulnerable areas, the KD line fits the dead fork and diverges downward, and the technical indicators are in a weak position. Positions decreased significantly by 63.09 million hands to 356,000, paying attention to changes in future positions, short-term range of 10500-12500; 5-9 spread -440 yuan / ton.

【Transaction Suggestion】

Zheng Mian ’s 2005 contract continues to be weak, further approaching historical lows, or will continue to explore the bottom and focus on the support below 10500. It is recommended that upstream cotton companies continue to do a good job of risk management; downstream textile companies may wait for the price to approach historical lows and moderate points according to the order Price replenishment; radical investors consider the 09 contract to reach near the historical low, try more light positions, the profit and loss ratio 4: 1, position control within 15%.

Disclaimer: This article originates from the Internet and the copyright belongs to the original author; if there is any infringement, please inform it in time and delete it after verification.

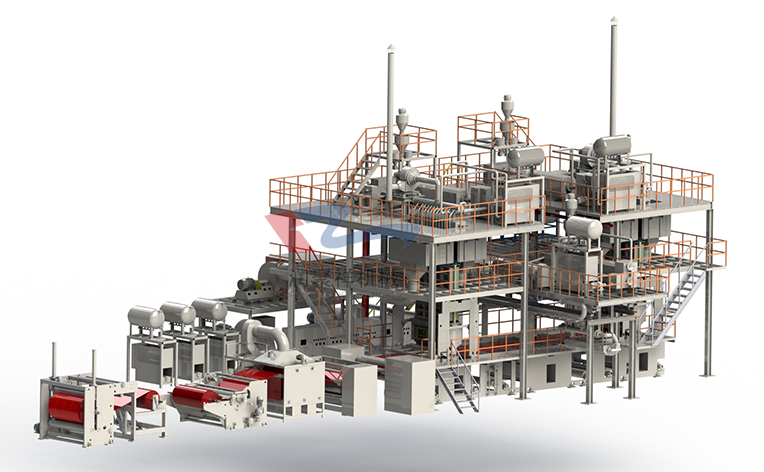

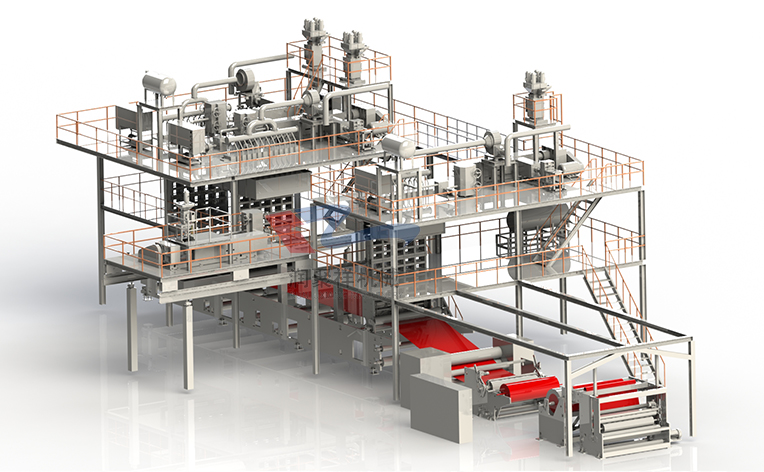

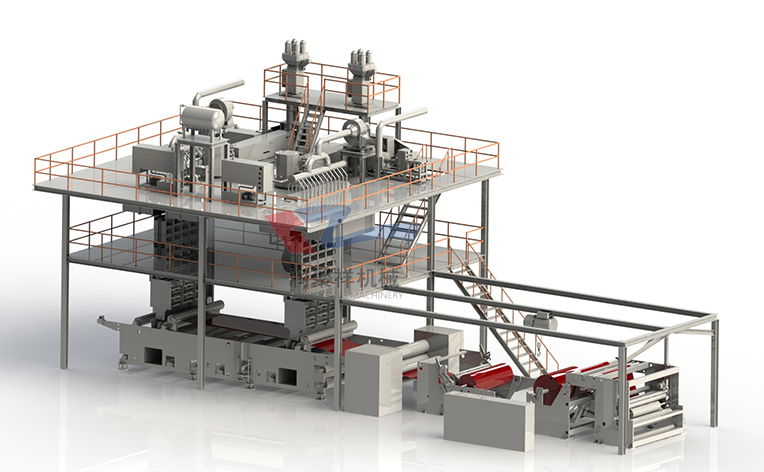

Qingdao Runjuxiang Machinery Co., Ltd. is specialized in producing non-woven equipment, non-woven fabric production line, spun-melt non-woven fabric production line, melt-blown non-woven fabric production line, non-woven fabric machinery, melt-blown non-woven fabric equipment, etc.

If you want to know more about our company, please contact: Mr. Gu 18661750769 Website: http://www.qdrunjuxiang.com

- In the prelude of early winter,

- The volume of industrial textile

- After the Minor Snow season, Qin

- Innovation and upgrading in the

- The non-woven fabric machinery o

- The operation of China's industr

- As the chill of November intensi

- The textile industry forges new

- What are the wide application fi

- A brief overview of the operatio

- About RunJuXiang

- Company Profile

- Company Culture

- Non-woven production line

- Spunbond nonwoven production line

- Two-component Bi-Co

- Spun melted nonwoven production line

- Equipment Accessories

- Meltblown nonwoven production line

- Non-woven products

- News Center

- Company News

- Show Information

- Contact Us

- Contact RunJuXiang

- Online Message