- Contact:Ms. Zhang

- Cel:0086-18053229518

- Mail:info@qdrunjuxiang.com

- Add:Chengma Road, Qijialing Village, Tongji New District, Jimo City, Qingdao

Consumption accounts for about 70% of the US economy and is the main engine driving US economic growth. Recently, the US retail industry, which is closely related to consumption, has fallen, and the bearish data has been superimposed on the “closed store tide”, which has cast a shadow over US consumption and economic prospects.

According to data released by the US Department of Commerce on the 16th, US retail sales in September fell by 0.3% from the previous month, falling for the first time in seven months, and significantly lower than market expectations. As a key indicator of US consumer momentum, the unexpected decline in retail sales shocked market confidence, and the three major stock indexes of the New York stock market fell across the board on the 16th.

In addition to bad data, the US retail industry is also facing a "closed shop tide." According to a research report released by Credit Suisse recently, the US retail industry has announced the closure of 7,600 stores so far this year, a record high. Among them, the well-known American fashion chain brand "forever 21" filed for bankruptcy protection recently triggered media debate.

Many analysts believe that the poor performance of retail sales is affected by trade frictions. Chris Lapki, chief economist at Mitsubishi UFJ Financial Group, said that the sluggish US consumer spending in September is likely to be the result of economic and trade friction. If retail sales fall for three consecutive months, it means the economy may decline. .

Previously, surveys by various organizations such as the World Large Enterprise Research Association and the University of Michigan showed that tariffs have adversely affected US consumer confidence. Many analysts are also worried that the slowdown in the US job market will also affect consumption.

The latest statistics show that although the US unemployment rate remained at a low level in 50 years in September, new jobs have slowed down significantly. As of September, this year, the United States added 161,000 new jobs each month, down from 223,000 monthly averages last year.

Joel Narov, chief analyst of Nalov Economic Consulting in the United States, believes that income growth is necessary to maintain strong consumption, and household spending may slow as economic fundamentals decline. Catherine Judge, an economist at Imperial Bank of Canada, also said that consumption will cool as US employment growth slows.

Michael Pierce, a senior analyst at Kaitou International Macroeconomic Consulting Co., believes that the US annual growth rate of consumption in the third quarter is expected to decline from 4.2% in the second quarter to 2.5%, and the overall growth rate of the US economy will be dragged down.

In the opinion of many analysts, the "cool and warm" of the retail industry is not only important for judging the "speed" of the US consumer engine, but also a key factor affecting market confidence. Mike Lovinggart, vice president of investment strategy at E-Technology, said that retail sales are shrinking in September as retail sales are an important driver of the US economy.

Linsey Piegza, chief economist at Stiefel Financial, believes that the US economy has seen a decline in corporate investment and deterioration in manufacturing activity. However, as US consumption remains strong, many investors still do not care. After the release of retail data, investors worried that the sentiment was significantly worse.

In addition, the unexpected decline in retail data that day also significantly contributed to the market's expectation of the Federal Reserve to cut interest rates in October. According to the latest forecast made by the Chicago Mercantile Exchange based on the transaction data of the federal funds futures market, the probability of interest rate cuts in October is close to 90%.

- Qingdao Runjuxiang: A New Year's

- In 2026, a structural interest r

- Qingdao Runjuxiang: A New Beginn

- Analysis of the Textile and Garm

- At the beginning of the new year

- The Impact of the Fed's Interest

- In the prelude of early winter,

- The volume of industrial textile

- After the Minor Snow season, Qin

- Innovation and upgrading in the

- About RunJuXiang

- Company Profile

- Company Culture

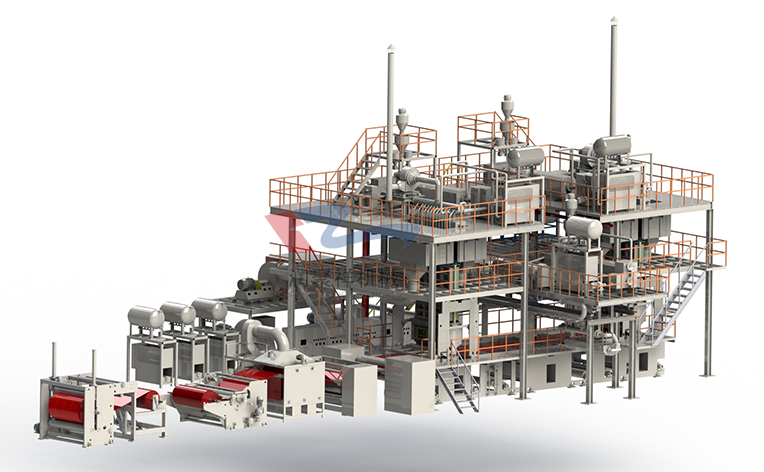

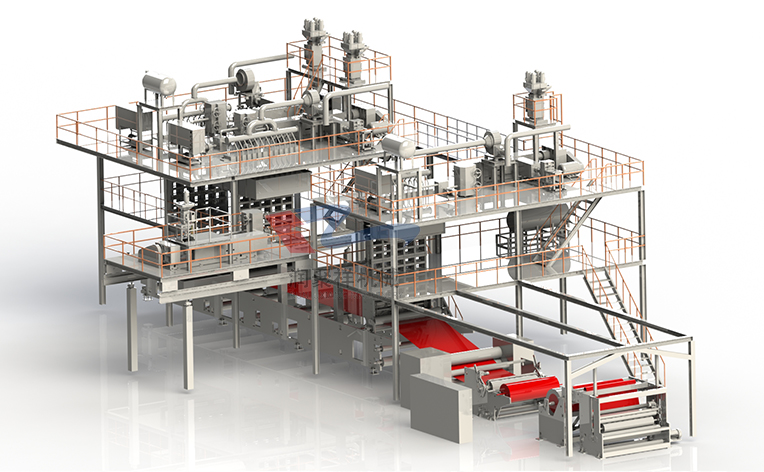

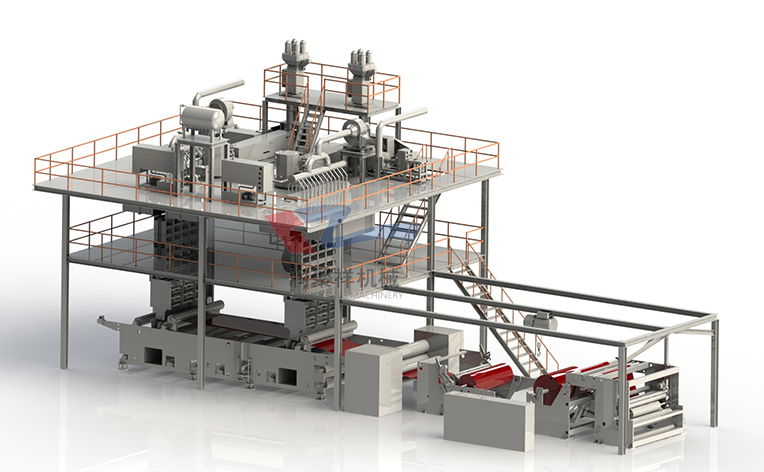

- Non-woven production line

- Spunbond nonwoven production line

- Two-component Bi-Co

- Spun melted nonwoven production line

- Equipment Accessories

- Meltblown nonwoven production line

- Non-woven products

- News Center

- Company News

- Show Information

- Contact Us

- Contact RunJuXiang

- Online Message