- Contact:Ms. Zhang

- Cel:0086-18053229518

- Mail:info@qdrunjuxiang.com

- Add:Chengma Road, Qijialing Village, Tongji New District, Jimo City, Qingdao

According to data from the China Foreign Exchange Trading Center, the central parity of the RMB against the US dollar was reported at 6.8859 on May 17, down 171 basis points from the previous trading day.

This is already a small float in the near future. On May 13, the offshore RMB depreciation fell below the 6.90 mark, and fell below 550 basis points in the day, hitting a new low since December last year. The onshore RMB closed at 6.8721, depreciating 603 points.

"I didn't expect that in an instant, the offshore RMB exchange rate against the US dollar fell below the 6.9 integer mark." A textile foreign trade company official was shocked.

According to the general understanding, the depreciation of the renminbi will increase the international competitiveness of export products. On the basis of the same order price, enterprises can obtain higher profits through exchange rate differences.

But in fact, the impact of devaluation on foreign trade enterprises is more subtle, not entirely positive.

For the above-mentioned foreign trade enterprises, the maximum execution price of the long-term foreign exchange settlement set by the enterprise at the beginning of the year is 6.85. If the enterprise settles at this price, it will bear the exchange loss of more than 300 basis points. Enterprises have to quickly settle all forward settlement agreements and settle foreign exchanges at the market price.

For small and micro enterprises, when the exchange rate fluctuates, they are afraid to pick up long orders and can only accept short orders. Because of the weak bargaining power of small and micro enterprises, the exchange rate of short-term exchanges will almost all be "eaten."

"Compared with the sharp depreciation of the renminbi, we hope that the exchange rate will be stable." The person in charge of the above-mentioned textile foreign trade enterprise told the reporter of China Times.

Tangled foreign trade enterprise

In the recent past, the plunge exchange rate has erased all the gains since this year.

Prior to this, on January 3, 2019, the offshore RMB closed at 6.8776, the highest hit 6.8944; on May 6, the offshore RMB depreciation fell below the 6.82 mark, and the daily depreciation exceeded 600 points;

On May 7, the data of China Foreign Exchange Trading Center showed that the central parity of the RMB against the US dollar was 6.7614, down 270 basis points from the previous trading day, setting a new low since February 19.

On May 13, the offshore RMB depreciation fell below the 6.90 mark, and fell below 550 basis points in the day, hitting a new low since December last year. The onshore RMB closed at 6.8721, depreciating 603 points.

For some large textile foreign trade enterprises, the depreciation of the renminbi has brought more profits to orders settled in US dollars. For example, the value of a box of exported clothing is 50,000 US dollars. It was previously converted into RMB about 310,000 yuan. After the exchange rate changed, it became 321,000 yuan. If you don't do anything, you will earn 11,000 yuan. In the case of hundreds of thousands or even millions of dollars in orders, the exchange gains are as high as several hundred thousand yuan.

In the face of investors' questions, a listed company's board secretary said bluntly that the company's export products are settled in US dollars, domestic purchases of raw materials, and the depreciation of the RMB will benefit the company. At the same time, a number of export enterprises such as Jiaxin Silk, Chuangyuan Culture and Yingke Medical were also affected by the depreciation of the RMB, which achieved a rise against the market.

However, for many companies, this devaluation may not be so good.

"This round of RMB depreciation has a big impact on the company. Although it has increased the competitiveness of export commodities, the depreciation has also made overseas customers hesitant when placing orders. They think that the renminbi will continue to depreciate, which will extend the next. Single time, affecting the transaction amount." Another textile foreign trade company official told reporters.

For example, when the exchange rate trend is clear, it can be based on past contracts; but when the RMB depreciates, many customers have to re-nego the price, the negotiation time is greatly extended, and it is normal to drag for ten days and a half.

This is more common for small and medium-sized textile companies with weak bargaining power.

For large enterprises, in order to share the risk of exchange rate fluctuations, the long-term settlement method is generally adopted, which also makes it difficult for large enterprises to enjoy all the benefits in the RMB depreciation. If the exchange rate fluctuations are uncertain in the future, the company may suffer losses.

The above-mentioned foreign trade enterprises set the maximum execution price for long-term foreign exchange settlement at 6.85. Under the background that the RMB depreciation exceeds expectations, enterprises will meet the foreign exchange exchange rate at this price and will bear the exchange loss of more than 300 basis points. This not only does not enjoy the benefits brought about by the devaluation, but also will bring losses.

"Compared with the depreciation, we hope that the exchange rate will remain stable. The depreciation may bring short-term benefits to some enterprises. However, in the long run, Chinese foreign trade enterprises cannot obtain more benefits from them." The person in charge of the above-mentioned textile foreign trade enterprises said.

In fact, the depreciation of the renminbi will also have a major impact on imports, forming input inflation. At present, China relies on imports in commodities such as oil and agricultural products. If it depreciates, it will lead to an increase in prices of various commodities such as domestic food prices and oil prices. The era of high inflation will come soon.

For SMEs, raw materials are dependent on imports, and rising raw material prices will lead to a rise in production costs, which will make SMEs more difficult to survive.

Will the renminbi break in the future?

In the eyes of market participants, the depreciation of the renminbi is still the embodiment of emotions.

"From a fundamental point of view, the escalation of trade conflict between China and the United States is a direct trigger for the depreciation of the exchange rate. The same situation happened in the past year. However, the current 'gap' of the economic fundamentals of China and the United States has narrowed, the Fed has also suspended interest rate hikes, and the pressure of RMB depreciation Has not yet risen sharply." Everbright macro research report shows.

In the context of the rise of global trade protectionism, trade uncertainty and exchange rate fluctuations have become the most concerned issues for enterprises. Today, there is still uncertainty in Sino-US trade negotiations, and the RMB exchange rate against the US dollar has again fluctuated sharply, which is also an important challenge that foreign trade companies have to face.

However, in the view of China Everbright, the RMB exchange rate may fluctuate at the current level in the short term, but it is unlikely to break through the 7th. However, once the economic and trade relations between the two countries have eased, the RMB may appreciate slightly.

"There is no room for a large appreciation of the RMB exchange rate and a sharp depreciation. On the one hand, the renminbi and the US dollar are two sides of a coin. Recently, the US economy has exceeded expectations in Europe. The US dollar is turbulent but lacks momentum that continues to rise sharply. Therefore, the RMB exchange rate has a phased and limited devaluation pressure.

On the other hand, under the external shock, the RMB exchange rate is more flexible, and it is not desirable for machinery to maintain the stability of the RMB exchange rate. Looking back at history, the slowdown in exports is a powerful factor that forces China to accelerate reforms and adjustments; and the slowdown in exports requires the RMB exchange rate to be more flexible. Monita researcher Zhong Zhengsheng said.

At present, analysts have different opinions on the future exchange rate. Many industry insiders generally expect that the RMB depreciation risk will remain manageable during the year. As long as the domestic economy does not experience major fluctuations, the RMB against the US dollar may be difficult to be strong at the beginning of the year, but it will not be depreciated sharply. There are also views that the trade rate war should currently depreciate.

In the view of some foreign media, the sharp depreciation of the renminbi is a "counterattack" against Sino-US trade friction. However, as early as the previous Boao Forum for Asia, China's central bank governor Yi Gang said that China will not use the RMB depreciation to deal with trade disputes.

"The focus of China's monetary policy is to focus on the domestic macroeconomic situation and serve the real economy. China's exchange rate mechanism is determined by supply and demand, and it is a market-determining mechanism. It works well and will continue to operate well in the future. China will not The devaluation of the renminbi to deal with trade disputes." Yi Gang said.

- Qingdao Runjuxiang: During the V

- 2026 Outlook: Strengthen interna

- Qingdao Runjuxiang: Commence wit

- New Year, New Momentum, New Jour

- Qingdao Runjuxiang: A New Year's

- In 2026, a structural interest r

- Qingdao Runjuxiang: A New Beginn

- Analysis of the Textile and Garm

- At the beginning of the new year

- The Impact of the Fed's Interest

- About RunJuXiang

- Company Profile

- Company Culture

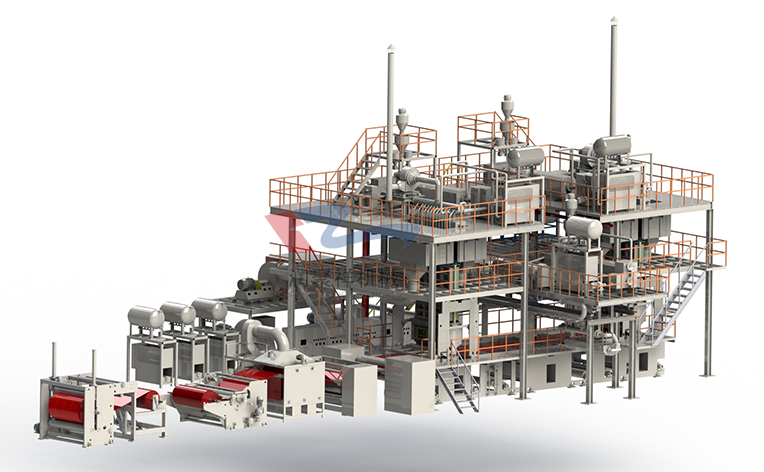

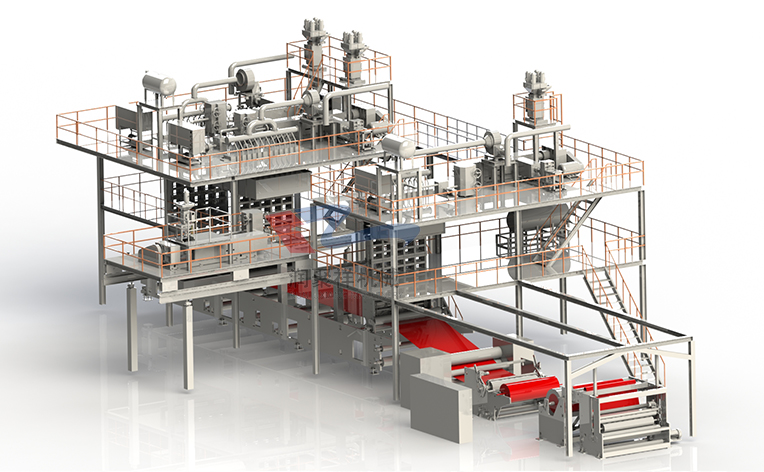

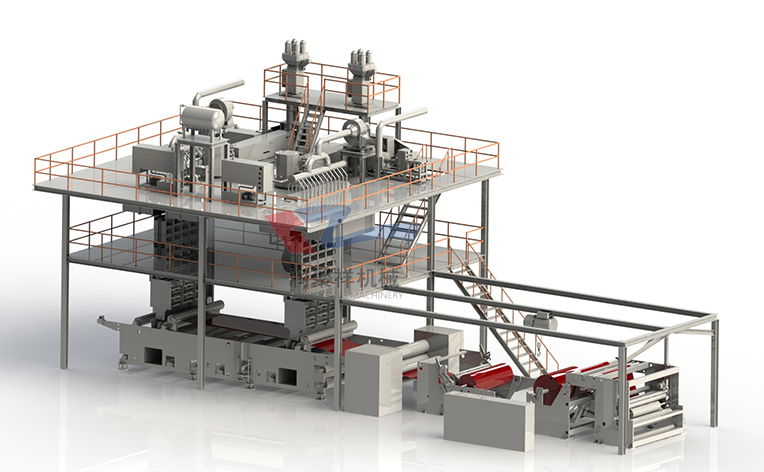

- Non-woven production line

- Spunbond nonwoven production line

- Two-component Bi-Co

- Spun melted nonwoven production line

- Equipment Accessories

- Meltblown nonwoven production line

- Non-woven products

- News Center

- Company News

- Show Information

- Contact Us

- Contact RunJuXiang

- Online Message