- Contact:Ms. Zhang

- Cel:0086-18053229518

- Mail:info@qdrunjuxiang.com

- Add:Chengma Road, Qijialing Village, Tongji New District, Jimo City, Qingdao

[]

Release date:[6:38:32]

Read a total of [] time

Related Products

Latest News

- At the beginning of the new year

- The Impact of the Fed's Interest

- In the prelude of early winter,

- The volume of industrial textile

- After the Minor Snow season, Qin

- Innovation and upgrading in the

- The non-woven fabric machinery o

- The operation of China's industr

- As the chill of November intensi

- The textile industry forges new

- About RunJuXiang

- Company Profile

- Company Culture

- Non-woven production line

- Spunbond nonwoven production line

- Two-component Bi-Co

- Spun melted nonwoven production line

- Equipment Accessories

- Meltblown nonwoven production line

- Non-woven products

- News Center

- Company News

- Show Information

- Contact Us

- Contact RunJuXiang

- Online Message

Key words:

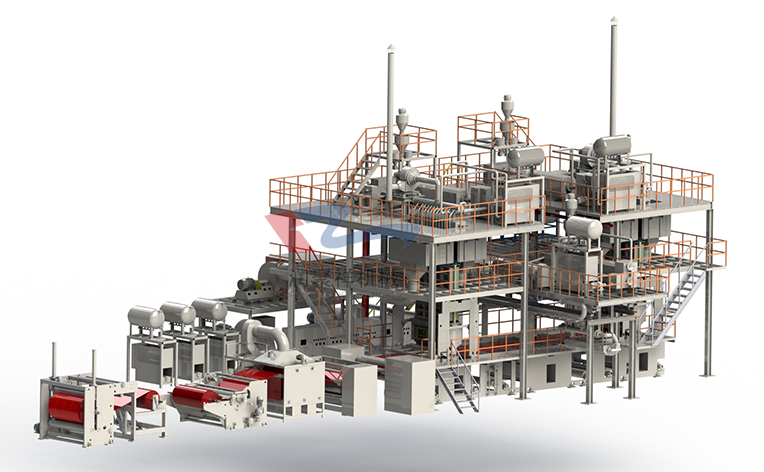

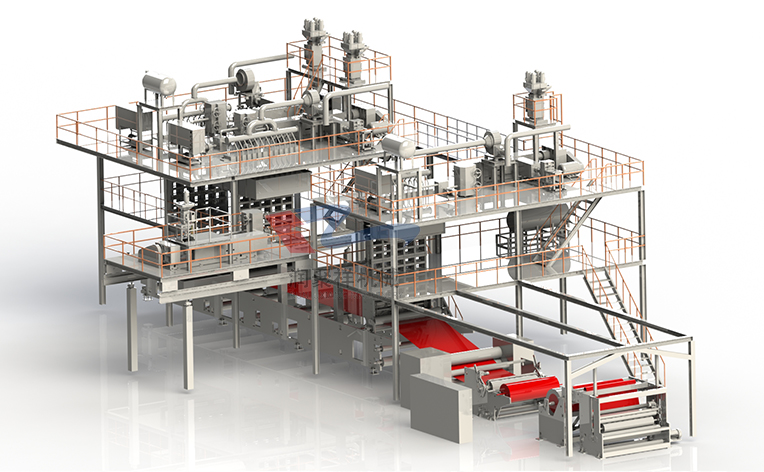

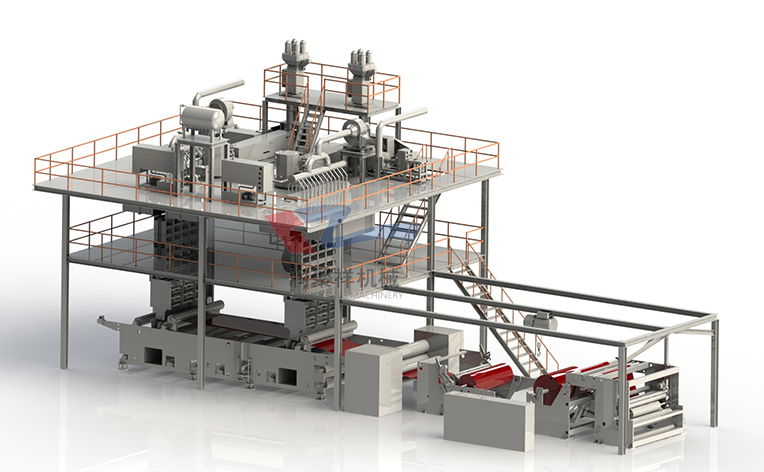

SMS spunbond and melt-blown non woven machinery line

Spunbond non woven machinery line

Spunbond and melt-blown non woven machinery line

SSMMS spunbond and melt-blown non woven production line

SSS spunbond non woven production line

Links:

China polypropylene network

China Engineering Fiber Network

Excellent non-woven fabric

Non-woven fabric manufacturers

Changzhou network optimization information

All rights reserved: Qingdao Runjuxiang Machinery Co., Ltd. Technical Support:中国丙纶网