- Contact:Ms. Zhang

- Cel:0086-18053229518

- Mail:info@qdrunjuxiang.com

- Add:Chengma Road, Qijialing Village, Tongji New District, Jimo City, Qingdao

The foreign trader has dizzy! The onshore and offshore RMB exchange rates both set a record for this round of appreciation!

According to data from the China Foreign Exchange Trading Center, the central parity of the renminbi was reported at 6.7010 on October 19, an increase of 322 points, a record high since April 18 last year. On October 20, the central parity rate of RMB continued to rise by 80 basis points to 6.6930.

In the morning of October 20, the onshore renminbi rose to 6.68 yuan, and the offshore renminbi rose to 6.6692 yuan, both setting new records since this round of appreciation.

The central bank has already taken action. Starting from October 12, 2020, the foreign exchange risk reserve ratio for forward foreign exchange sales will be reduced from 20% to 0. This will reduce the cost of companies' forward purchases of foreign exchange, help increase demand for foreign exchange purchases, and ease the rise of the renminbi.

Judging from the trend of the renminbi exchange rate that week, the onshore renminbi has partially fallen when the US dollar index has rebounded. Many companies regard this as an opportunity for foreign exchange settlement, while the offshore renminbi exchange rate has continued to rise.

Zhang Jiantai, chief Asian strategist at Mizuho Bank, said in the latest comments that the Central Bank of China has taken measures to lower the foreign exchange risk reserve ratio, indicating a change in its assessment of the outlook for the renminbi; considering Biden’s lead in opinion polls, the US election may become the renminbi. A risk event of appreciation rather than devaluation.

If you don’t dare to settle foreign exchange, you will lose money if you settle.

And foreign trade people have gone through the ups and downs during this period of time, and they have completely lost their temper.

If counting from the beginning of the year, the renminbi has appreciated by 4%. If calculated from the low point at the end of May, the renminbi exchange rate increased by 3.71% in the third quarter, the largest quarterly increase since the first quarter of 2008.

And not only against the U.S. dollar, the RMB has appreciated even more against other emerging currencies, such as 31% against the Russian ruble, 16% against the Mexican peso, 8% against the Thai baht, and 7% against the Indian rupee; appreciation against developed currencies It should be relatively small, for example, the relative depreciation of the euro is 0.8%, and the appreciation of the yen is 0.3%, but the appreciation of the US dollar, Canadian dollar, and British pound is more than 4%.

After the RMB has strengthened significantly in recent months, the willingness of enterprises to settle foreign exchange has declined significantly. The spot exchange rates from June to August were 57.62%, 64.17%, and 62.12%, which were far lower than the 72.7% in May, and also lower than the sales exchange rate during the same period, indicating that companies tend to hold more foreign exchange.

After all, if you found the exchange rate of 7.2 this year, but now it is less than 6.7, how can you settle for foreign exchange?

According to data from the People's Bank of China, the balance of foreign currency deposits of domestic residents and enterprises climbed for four consecutive months at the end of September, reaching 848.7 billion U.S. dollars, breaking the historical high set in March 2018. There may be payments that you and I are reluctant to settle.

The key factors affecting the exchange rate, but what if the yuan continues to appreciate?

- In the prelude of early winter,

- The volume of industrial textile

- After the Minor Snow season, Qin

- Innovation and upgrading in the

- The non-woven fabric machinery o

- The operation of China's industr

- As the chill of November intensi

- The textile industry forges new

- What are the wide application fi

- A brief overview of the operatio

- About RunJuXiang

- Company Profile

- Company Culture

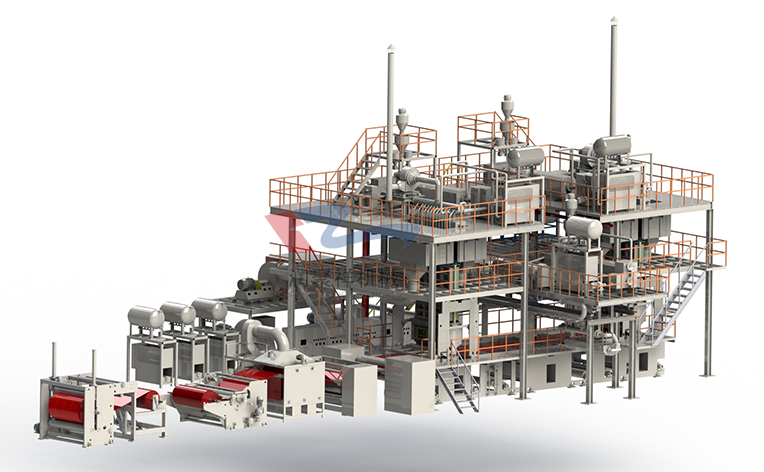

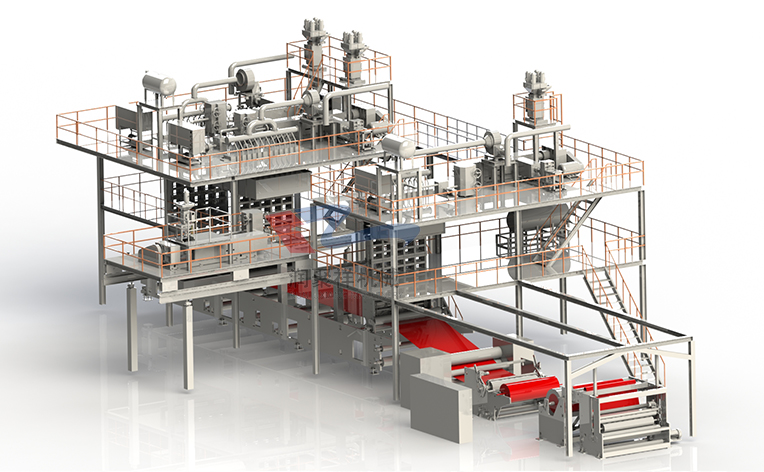

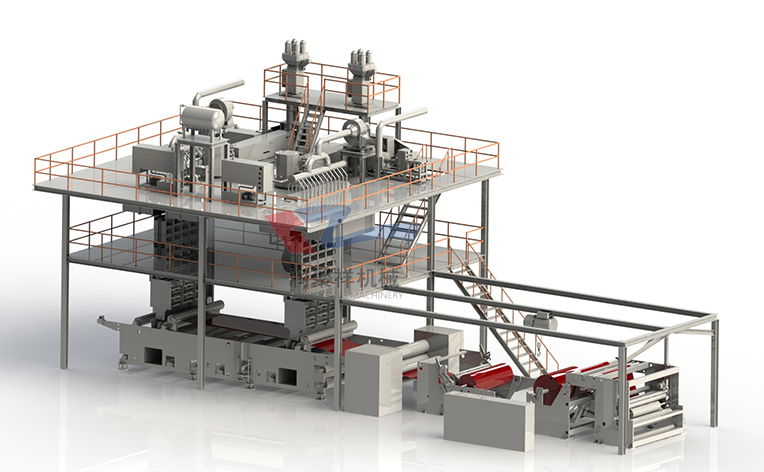

- Non-woven production line

- Spunbond nonwoven production line

- Two-component Bi-Co

- Spun melted nonwoven production line

- Equipment Accessories

- Meltblown nonwoven production line

- Non-woven products

- News Center

- Company News

- Show Information

- Contact Us

- Contact RunJuXiang

- Online Message