- Contact:Ms. Zhang

- Cel:0086-18053229518

- Mail:info@qdrunjuxiang.com

- Add:Chengma Road, Qijialing Village, Tongji New District, Jimo City, Qingdao

In recent years, the supply of polyester staple fiber has increased significantly. In 2020, the industry still has more than 600,000 tons of equipment planned to be put into production, but the downstream traditional demand is not as strong as the increase in supply. The industry's supply and demand contradictions or once again intensified, market competition The situation is becoming increasingly fierce.

Specifically, in 2019, the direct-spun polyester staple fiber industry has newly put into operation a total of 620,000 tons, with a total capacity of 7.910 million tons, an increase of 8.52% year-on-year. The new production capacity is mainly based on conventional cotton staple fiber and filled staple fiber. The details are as follows:

In terms of actual output, in 2019, the actual output of domestic staple polyester staple fiber was 6,526,200 tons, a year-on-year increase of 13.46%. Since 2019, with the continuous operation of private large-scale refining and chemical production, the polymerization cost has continued to decline during the year, which has made the price advantage of direct-spun polyester staple fiber very obvious. The market has replaced some of the market for recycled staple fiber in many fields, especially filled staple fibers. Fiber replacement is more obvious.

Due to the high overlap between direct-spun polyester staple fiber and the downstream fields of high-strength, low-strength imitation and large-scale imitation, generally speaking, when the price difference between the two exceeds 2,000 yuan / ton, the advantages of regeneration are more obvious; when the price difference between the two is less than At 1,000 yuan / ton, the advantages of regeneration will diminish.

Entering 2019, the development of private refining and chemical industry has significantly reduced the cost of polyester. The price of direct-spun polyester staple fiber has fallen all the way. However, the actual decline in recycled staple fiber has been limited due to cost constraints. The price difference between the two has once again fallen below 500 yuan / ton. Level, individual time periods and even little spread. Especially in the filling field, due to the narrow long-term price difference, the start-up load of regenerative hollow companies has continued to be low, and the inventory pressure has continued to be large, which has also prompted some companies to innovate or switch to the original hollow market.

Therefore, despite the continuous increase in supply, the market has gradually shown the contradiction of oversupply. However, due to the average profit of the company in 2019 is still around 200 yuan / ton, and the overall inventory at the end of the period is low, the direct spinning polyester staple fiber industry in 2020 still has Some new production is expected.

In 2020, the direct-spun polyester staple fiber industry still has more than 620,000 tons of new capacity planned to be put into production. By then, the industry's new capacity will reach 8.521 million tons, a year-on-year increase of 7.85%. However, the new capacity may tend to be filled and differentiated staple fiber, and for conventional varieties, in addition to price advantages, other aspects of competitiveness will weaken significantly.

Taken together, the macro situation in 2020 is still complex and changeable, and there are many uncertain factors. The polyester staple fiber industry will still face greater challenges in the context of an uncertain trade environment and a re-transition of the domestic supply and demand pattern.

- Qingdao Runjuxiang: During the V

- 2026 Outlook: Strengthen interna

- Qingdao Runjuxiang: Commence wit

- New Year, New Momentum, New Jour

- Qingdao Runjuxiang: A New Year's

- In 2026, a structural interest r

- Qingdao Runjuxiang: A New Beginn

- Analysis of the Textile and Garm

- At the beginning of the new year

- The Impact of the Fed's Interest

- About RunJuXiang

- Company Profile

- Company Culture

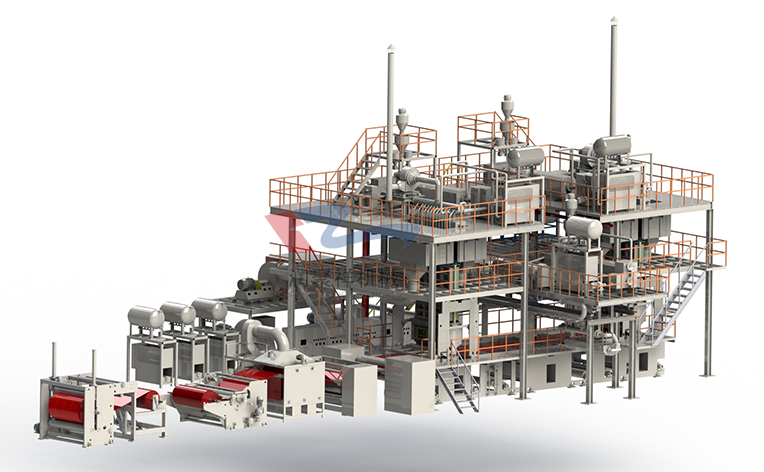

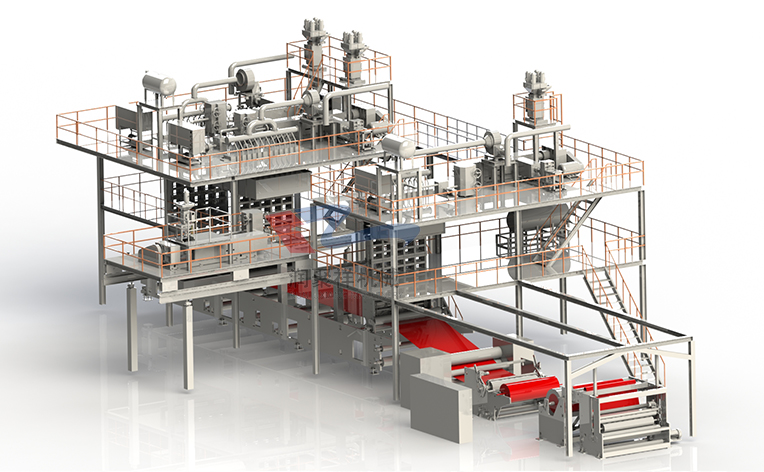

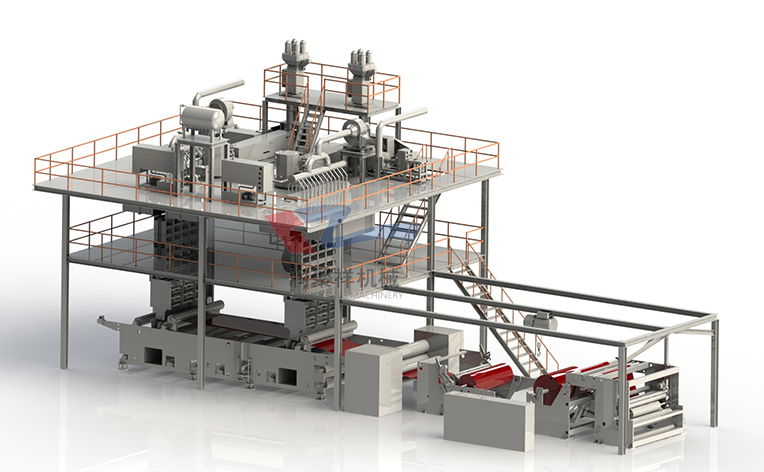

- Non-woven production line

- Spunbond nonwoven production line

- Two-component Bi-Co

- Spun melted nonwoven production line

- Equipment Accessories

- Meltblown nonwoven production line

- Non-woven products

- News Center

- Company News

- Show Information

- Contact Us

- Contact RunJuXiang

- Online Message